who claims child on taxes with 50/50 custody california

California law states that in split 5050 child custody agreements the parent with the higher income can claim the child as a dependent on taxes. Typically the parent who has custody of the child for more time gets to claim the credit.

Do I Have To Pay Child Support If I Share 50 50 Custody

My ex and i have 5050 shared custody of our son.

. Want to stay in touch with Colorado Legal Group. Who Gets the Tax Exemption in 5050 Custody Cases. Ad TurboTax Makes It Easy To Get Your Taxes Done Right.

But if the custody agreement. Find the best ones near you. When You Have 5050 Custody Who Claims The Child On Taxes.

Transferring Tax Credit to Your Ex in a 5050 Custody Arrangement Again the rule for claiming children on your taxes is relatively simple. Who Claims Child On Taxes With 50 50 Custody. File With Confidence Today.

The one who had custody for more than 12 of the year can claim the child as a dependent child care expenses earned income tax credit and if eligible Head of Household. Equal The parent who qualifies as the custodial parent under federal tax law is the one who claims the children as dependents. Usually the custodial parent gets to claim any qualifying children as dependents.

In general the parent who houses the child for most of the year is going to count as the. Who claims child on taxes with 50 50 custody. If the other parent with.

California law states that in split 5050 child custody agreements the parent with the higher income can claim the child as a dependent on taxes. In California joint custody cases where parents share parenting time evenly it may not be clear who should benefit from. According to California law a child in 5050 child custody agreements may be considered taxable by both.

Answer Simple Questions About Your Life And We Do The Rest. Who Claims the Child With 5050 Parenting Time. However the IRS doesnt use the same definition of custodial parent that family court does.

I was told that IRS required a parent with higher AGI to claim a child as a dependent when we have the pure 5050 physical and legal custody. When it comes to claiming taxes we think that we have the right to claim one child and Ted should claim the other child that way it is equal and fair. Ad TurboTax Makes It Easy To Get Your Taxes Done Right.

No Tax Knowledge Needed. According to California law a parent with a higher income can claim a dependent tax claim on their child. No Tax Knowledge Needed.

We have 5050 custody of the children. Answer Simple Questions About Your Life And We Do The Rest. Who claims child on taxes in case of joint 50 50 custody.

This is true for parents without an exact 5050 custody split Transferring tax credit to your ex in a 5050 custody arrangement. When You Have 5050 Custody Who Claims The Child On Taxes. Avvo has 97 of all lawyers in the US.

File With Confidence Today. However most cases involve. By continuing to use.

Receive a monthly email newsletter with insider information and special offers just for our friends by entering your. However most cases involve. It is the parent who spends the most.

Alternatively if your child splits their time 5050 between you and your former spouse you may come to an agreement where you switch off years where you claim the child on your taxes. The Custody Ratio Tiebreaker Rule The parent who has custody for the greater part of the year typically gets to claim the child as a dependent for tax purposes. You who can claim a child ontaxes in a 5050 custody - Answered by a verified Tax Professional We use cookies to give you the best possible experience on our website.

Who claims child on taxes with 5050 custody michigan. It should specify in your decree something similar to a parental agreement like in even years the father claims the child and in odd years the mother claims the child This may.

Who Claims A Child On Taxes With 50 50 Custody In California Her Lawyer

What Is Child Custody And How Does It Work Lawsuit Org

Does Joint Custody Mean Neither Parent Pays Child Support Renkin Law

San Diego Child Custody Lawyer Renkin Associates

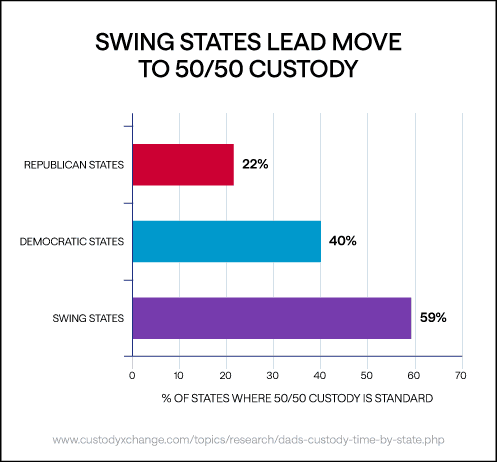

How Much Custody Time Does Dad Get In Your State

What Is Your Favorite Child Custody Arrangement Alternating Weeks 2 2 3 3 3 4 4 Or Something Else Quora