tax strategies for high-income earners 2020

Treatment by private doctors is also paid by the government when the doctor direct bills the Health Department Bulk Billing. Share of low-pay earners who are female vs GDP per capita.

Tax Strategies For High Income Earners 2022 Youtube

For 2021 and later years only high-income earners about 10 are required to pay solidarity surcharge and it will be eliminated for 90 taxpayers.

. Model to an income tax surcharge known as the Medicare Levy which was set at 15 with exemptions. Accounting for 15 of total US. By estimating the overall risk of health risk and health system expenses over the risk pool an insurer can develop a.

We are moving in a new direction focusing our efforts more fully on making transformational change within organizations to create equity and inclusion in the workplace for all. The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. An early governmental measure that slightly reduced.

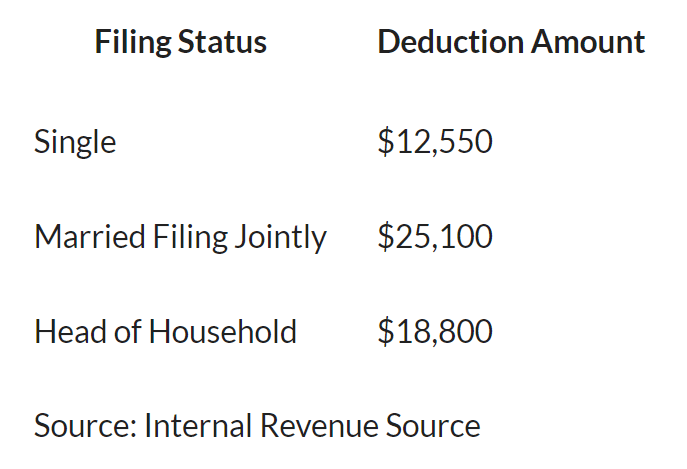

10 billion in the next few years to improve health care in the country. 15 2017 taxpayers can deduct home mortgage interest on their first 750000 or 375000 of mortgage debt for married filing. The alternative minimum taxable income AMTI is calculated by taking the taxpayers regular income and adding on disallowed credits and deductions such as the bargain element from incentive stock options.

The SECURE ACT includes several key changes that affect tax reduction strategies for high-income earners. Mortgage interest tax deduction. Casarico and Voitchovsky 2018.

Increased wages are believed to be more effective in boosting demand for goods and services than central banking strategies which put the increased money supply mostly into the hands of wealthy persons and institutions. Specifically important numbers for 2022 include. Income inequality has fluctuated considerably since measurements began around 1915 declining between peaks in the 1920s and 2007 CBO data or 2012 Piketty Saez Zucman dataInequality steadily increased from around 1979 to 2007 with a small reduction through 2016 followed by an increase from 2016 to 2018.

An additional levy of 1 is imposed on high-income earners without private health insurance. Each year high-income taxpayers must calculate and then pay the greater of an alternative minimum tax AMT or regular tax. Advancing Racial Equity and Justice.

Lessons from a century of legislation in high-income countries. By sticking to a tax-cut plan made in 2018. Tax decreases on high income earners top 10 are not.

2 days agoThe proposition would increase the income tax for people making over 2 million a year by 175 percent for a 20-year period or until three years after statewide emissions drop to 80 percent of. The Journal of Economic Perspectives 311 205-230. The age for Required Minimum Distributions or RMDs was raised to 72 from 70-½ in 2020 although if you turned 70-½ in 2019 you still needed to start RMDs in 2020.

CAP applies a racial equity lens in developing and advancing policies that root out deeply entrenched systemic racism to ensure everyone has an opportunity to. Capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets. Health insurance or medical insurance also known as medical aid in South Africa is a type of insurance that covers the whole or a part of the risk of a person incurring medical expensesAs with other types of insurance risk is shared among many individuals.

As you can imagine the couple has many income streams to report. The maximum income tax rate is 45 percent plus there is solidarity surcharge of 55 percent of the income tax. In July 2019 Biden and his wife Jill Biden released their tax returns from 2016 to 2018.

The tax doesnt apply to phototherapy services performed by a licensed medical professional on his or her premises. Unemployment in Europe 2020 according to Worldbank. Corporate taxes in 2019 and 2020.

Joe and Jill file returns jointly. Alternative minimum tax calculation. As of 2020 the health insurance tax called deposition to an OMS fund is 51.

Private health insurance is only accessible to self-employed workers high-income. Americas billionaires avail themselves of tax-avoidance strategies beyond the reach of ordinary people. Payments are made along with Form 720 Quarterly Federal Excise Tax Return.

After over 40 years of serving working parents the Working Mother chapter is coming to a close. Medicare is funded partly by a 15 income tax levy with exceptions for low-income earners but mostly out of general revenue. To the millions of you who have been with us.

A 10-percent excise tax on indoor UV tanning services went into effect on July 1 2010. Using tax records they investigated the incomes of women and men separately across nine high-income countries. Tax avoidance strategies arent solely for the rich -- plenty of tax deductions and credits are available for middle- and low-income taxpayers too.

Including reduced marginal rates for high income earners. For tax year 2020 the income limit ranges from 15820 if youre single and have no children to 56844 if youre married and filing jointly and have three or more qualifying children. During the fiscal year 2021 the IRS collected more than 41 trillion in gross taxes processed more than 261 million tax returns and other forms and issued more than 11 trillion in tax refunds including 5857 billion in Economic Impact Payments and.

Which came into effect in 2018-19 and 2020-21 respectively were smaller and largely. For debt accrued after Dec.

Tax Reduction Strategies For High Income Earners 2022

9 Ways For High Earners To Reduce Taxable Income 2022

Tax Reduction Strategies For High Income Earners 2022

5 Outstanding Tax Strategies For High Income Earners Debt Free Dr Dentaltown

Tax Strategies For High Income Earners Lalea Black

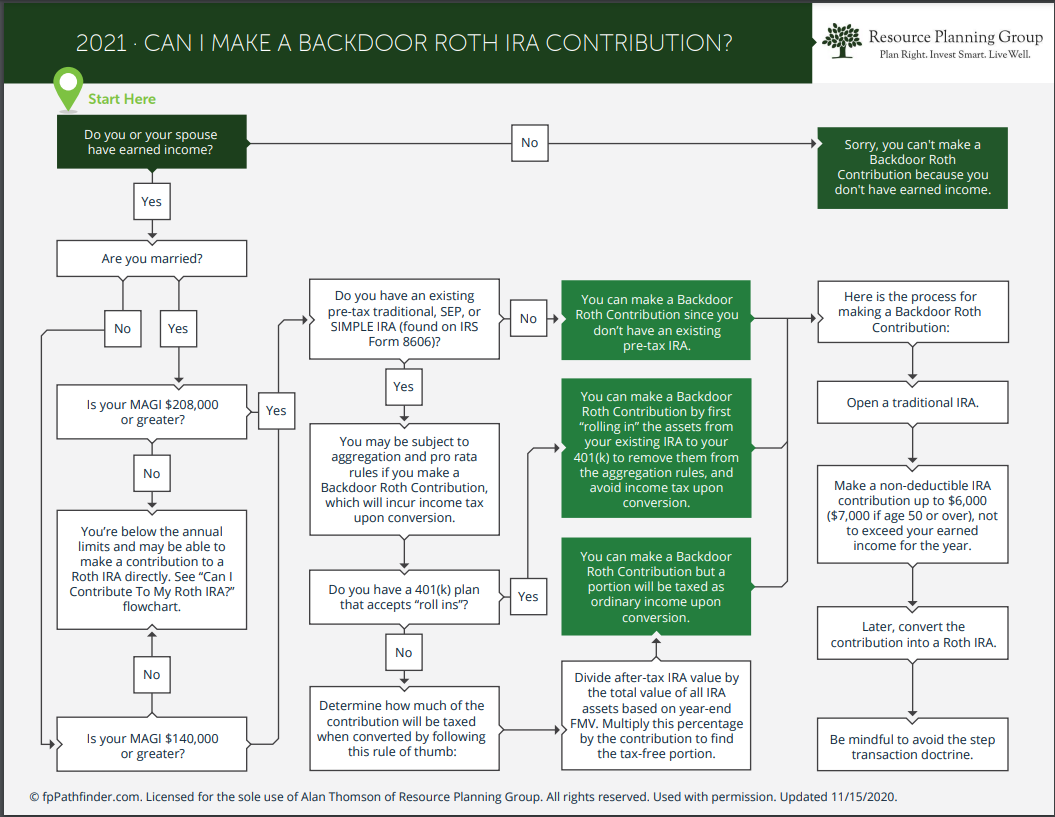

Opportunity For High Income Earners The Backdoor Roth Conversion Resource Planning Group

5 Tax Strategies For High Income Earners Pillarwm

High Income Earner Tips To Optimize Your 2020 Tax Return Davis Wealth Advisors

Raising State Income Tax Rates At The Top A Sensible Way To Fund Key Investments Center On Budget And Policy Priorities

2021 Taxes 8 Things To Know Now Charles Schwab

Tax Advantaged Savings Accounts For High Income Earners Paces Ferry Wealth Advisors

The Hierarchy Of Tax Preferenced Savings Vehicles

Biden Tax Plan And 2020 Year End Planning Opportunities

5 Outstanding Tax Strategies For High Income Earners

7 High Income Tax Strategies To Reduce Taxes No Brainer Wealth

Tax Strategy Papers Published 30 Rate Could Save Middle Income Earners 1 000 A Year

5 Tax Strategies For High Income Earners Pillarwm

The 4 Tax Strategies For High Income Earners You Should Bookmark